Christians Against Poverty (CAP)

Lifting people out of debt and poverty

Our churches partner with six other local churches and the award-winning national charity Christians Against Poverty to help local people find a practical, lasting solution to debt and poverty through debt counselling and community groups.

Locally we offer CAP Debt Help for those feeling weighed down by debt, and the CAP Money Course that teaches budgeting skills and a simple, cash-based system that works.

What difference does CAP make?

As of October 2021, 48 individuals and families had become debt free through Didcot and Wallingford Area CAP Debt Centre, and a number had come to new or renewed faith in Jesus Christ.

Click on the links below for stories of lives changed

How can I help?

-

You can volunteer to do home visits, befriend clients and/or help in other practical ways - click here for more info

-

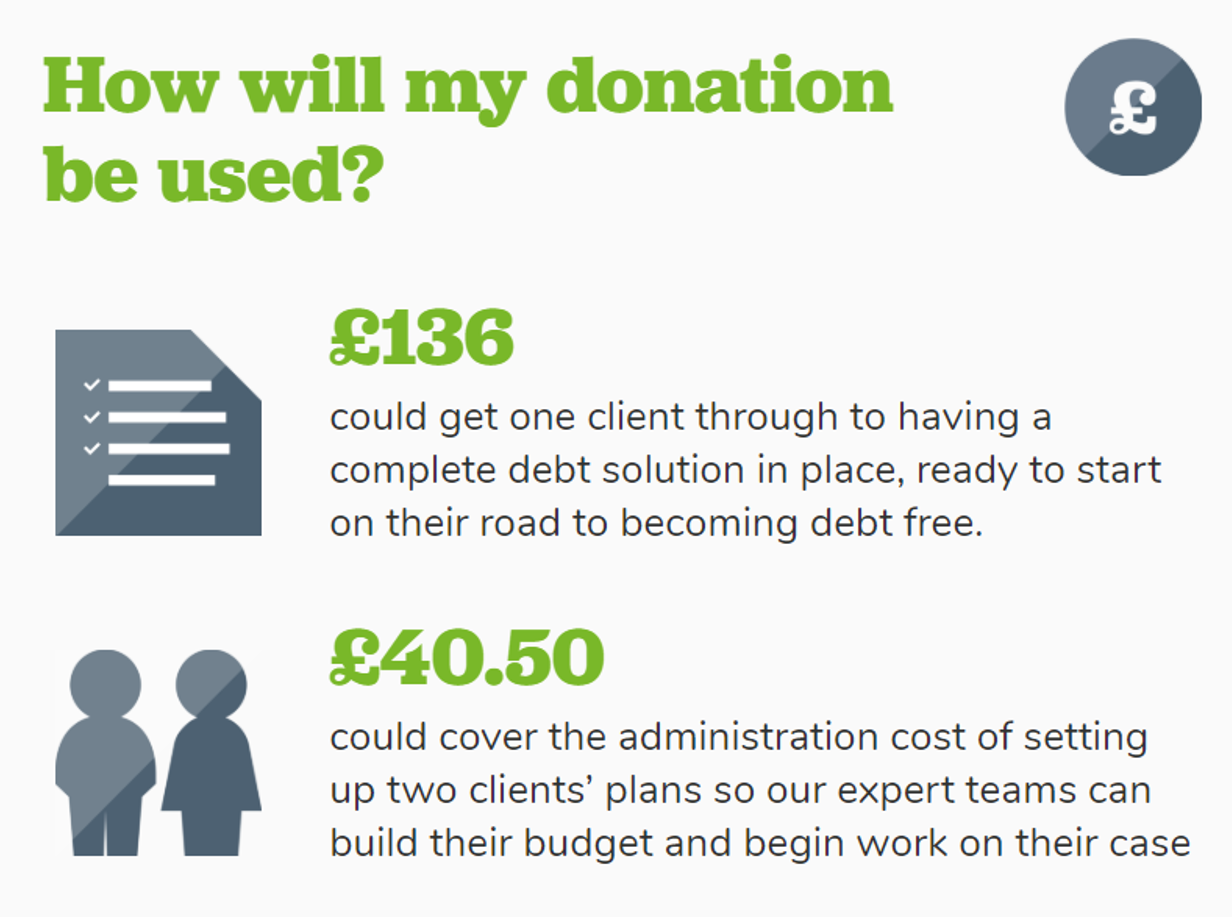

You can make a donation or regular gift - click here for more info

More information

A report of the Didcot and Wallingford Area Debt Centre can be found here